Personal / telephone consultation

Advisory price per minute based on Amend Finance Portfolio Performance YTD (year to date)

- 27. June 2025

- 57.12 / minute

Global Markets Sunday News

Iran conflict and tariffs: a hot start to the summer

The financial markets recorded relatively limited fluctuations amid geopolitical tensions. There were numerous central bank meetings this week, but these did not trigger any major reactions. A wait-and-see attitude prevails, as Donald Trump will have to decide in the next two weeks whether the US will attack Iran.

Tops of the week

Entain +12.75%: Ladbrokes’ parent company has published solid figures and prospects for its joint venture BetMGM. These are thanks to the dynamic development of the iGaming and online sports betting divisions.

Stora Enso +15.94%: The Swedish-Finnish paper and packaging manufacturer is facing a strategic review of its forestry operations. A partial spin-off is on the cards. The move is intended to boost growth, reduce debt and enhance the value of forestry assets that set the company apart from its competitors.

Kering +3.73%: Luca de Meo, who successfully got Renault back on track after the pandemic, is now likely to try to repeat the same feat at the parent company of Gucci and Balenciaga. Although he has spent his entire career in the automotive industry, he specializes in brand realignment and marketing. He is also no stranger to luxury goods such as Swiss watches.

MTU Aero Engines +9.32%: The German defense company has revised its medium-term outlook upward. Following this announcement, several analysts revised their price targets.

Saab +6.98%: The defense company received an order from the Swedish Army for the delivery of Giraffe 4A radar systems worth SEK 1.4 billion.

AMD +10.4%: The US semiconductor manufacturer has unveiled its new MI350X chip. The graphics processor is intended to revive the company’s GPU division, which has lost some momentum in recent months.

Marvell Technology +9.41%: Bank of America published an optimistic assessment of the US network chip manufacturer after it paved the way for an expansion of its chip offering at its latest AI event. According to analysts, the market for data centers is expected to grow strongly until 2028, underpinning the company’s business outlook.

Warner Bros +4.89%: Creditors approved the debt reduction restructuring plan, an important step toward the strategic split of the media and entertainment group.

Flops of the week

Rémy Cointreau -11.12%: The spirits manufacturer is in serious trouble. Broker Alpha Value is pessimistic about the full-year results given the impact of tariffs and the generally difficult market environment. The cognac division, which generates almost 65% of total sales, is likely to be the hardest hit.

Colruyt -6.63%: The retailer is losing further market share in Belgium. Competition is very strong and demand is stagnating. Colruyt is no longer able to differentiate itself from its competitors, and the outlook for the new fiscal year is rather subdued.

Lennar -2.02%: The US homebuilder reported better-than-expected quarterly results. However, high interest rates are weighing on business, and management sees price cuts as the only lever to maintain volume.

Teleperformance -16.95%: The CRM service provider’s new strategy disappointed investors. They see a discrepancy between the business opportunities offered by AI, which the company points to, and its conservative medium-term targets. Teleperformance is no longer growing as strongly as in previous years.

Visa / Mastercard -5.17%: New US regulations on stablecoins could reduce the importance of traditional payment solutions for certain types of transactions. Trading platforms such as Coinbase, on the other hand, are benefiting from the new situation.

Commodities

Energy: Due to increasing hostilities between Tehran and Tel Aviv, the situation on the crude oil markets remained tense. As a result, oil prices rose, especially for Brent crude. Brent is more sensitive to international tensions than US WTI, which is more influenced by the dynamics of its domestic market. In other words, the spread between Brent and WTI tends to widen when geopolitical tensions increase. Although the market remains tense, there are no signs of an immediate disruption to global oil supplies. The US is giving itself two weeks to decide on possible military involvement, which could open the door to further diplomacy. International talks, particularly between Iran and European ministers, are paving the way for a possible peaceful resolution to the conflict. Meanwhile, oil continues to flow – including from Iran. At least in the short term, investors continue to consider the nightmare scenario of a closure of the Strait of Hormuz unlikely. And according to the latest reports from OPEC and the International Energy Agency, global oil supplies are still likely to be sufficient to meet current demand. Admittedly, any further escalation of the security situation in the Strait of Hormuz could quickly change this dynamic. The market continues to watch for signs of de-escalation – or indeed a deterioration in the situation.

Metals: Although it may seem illogical, gold lost ground this week despite geopolitical tensions. The precious metal fell for five days in a row and is now trading at around USD 3,350. The appreciation of the dollar and, above all, the US Federal Reserve’s policy, which dampened hopes of an interest rate cut, weighed on the gold price. Copper also declined in London. Disappointing data on real estate prices in China put pressure on the price. A ton of copper now costs USD 9,615 (spot price).

Agricultural products: In Chicago, corn prices stabilized at 445 cents per bushel, while wheat rose to 585 cents (contract expiring in September 2025). This purely technical movement is related to the entry into short positions. From a fundamental perspective, pressure from harvests in Europe and the Black Sea region could weigh on prices.

Macroeconomics

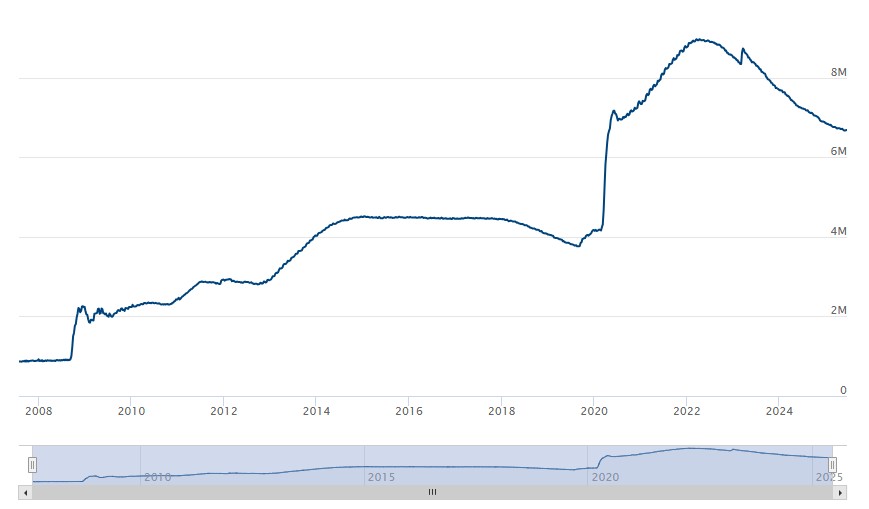

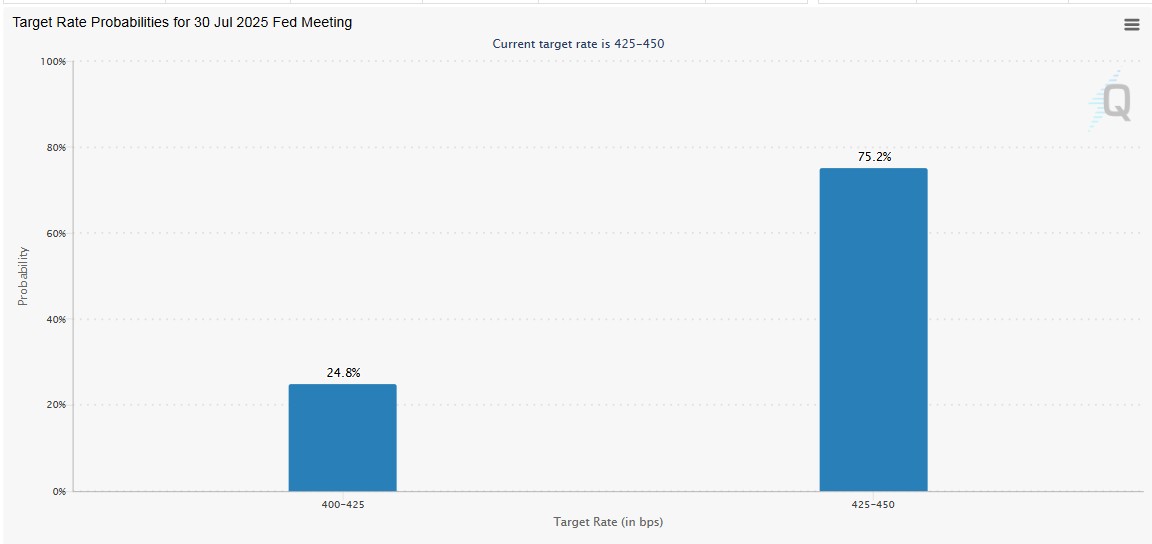

Market sentiment: It’s the weekend for central banks. After the ECB, it was the turn of the Fed, the SNB and the BoE. They faced the delicate task of venturing an economic outlook and a forecast for monetary policy. The British monetary authorities left interest rates unchanged, while the Swiss central bank cut its key rate to zero percent. This proves that low interest rates and a strong currency are perfectly compatible, provided that the other conditions are right: political and fiscal stability, a well-developed infrastructure, pricing power for exports, etc. In the US, the situation is not quite so simple for the Fed. It has to weigh up the risks of higher inflation, a (too) robust labor market and growing geopolitical uncertainties. We advise investors to exercise caution and wait and see, even though analysts still expect two interest rate cuts by the end of the year.

Cryptocurrencies

Bitcoin closed the third week in a row at around $105,000. Bitcoin spot ETFs continue to gain momentum with over $1 billion in net inflows since Monday. In general, the most important, i.e., highest-valued cryptocurrencies trended sideways this week. The latest news came from Coinbase: The platform is preparing a strategic realignment and plans to introduce trading in tokenized stocks available around the clock. To secure the legal basis for this plan, it has applied to the US Securities and Exchange Commission (SEC) for a waiver (“no-action letter”). What is the purpose of this step? Financial assets (stocks, bonds, funds) are to be natively digitized to simplify access and make acquisition more cost-effective. In addition, Coinbase and Gemini are likely to receive their MiCA license in Luxembourg and Malta. This would open up the entire European market to them. This is a balancing act for Europe: on the one hand, an attractive environment for US crypto giants needs to be created, while on the other hand, a high level of investor protection must be guaranteed in a market that is now worth a total of USD 3.2 trillion.

Outlook

Will Donald Trump remind the US’s “partners” in the first week of summer that no trade agreement has yet been signed? We expect the US president to make this point bluntly between two statements on Iran. Next week, the purchasing managers’ indices for the leading economies for June will be released on Monday, followed by the latest US consumer prices on Friday. In between, Fed Chairman Jerome Powell will answer questions before Congress on Tuesday and hold his semi-annual hearing on Wednesday. Looking ahead to the reporting season, several companies with different fiscal years will present their figures, including Prosus, Fedex, Micron, and Nike.

Bitcoin | Gold

The path to freedom

Dr. Udo Amend, a renowned expert in the fields of cryptography and finance, has been working intensively on these topics for decades. With his extensive knowledge and experience, he sheds light on the fascinating connections between Bitcoin and gold in his book “Bitcoin | Gold – The Path to Freedom”.