The stock market crash of 1973 to 1974 caused a so-called bear market between January 1973 and December 1974. All the world’s major stock markets were affected, especially the United Kingdom. It was one of the worst stock market declines since the Great Depression. The other is the financial crisis of 2007-2008.

The crash came after the collapse of the Bretton Woods system over the last two years, with the associated “Nixon shock” and the devaluation of the US dollar under the Smithsonian agreement. Added to this was the outbreak of the 1973 oil crisis in October of that year.

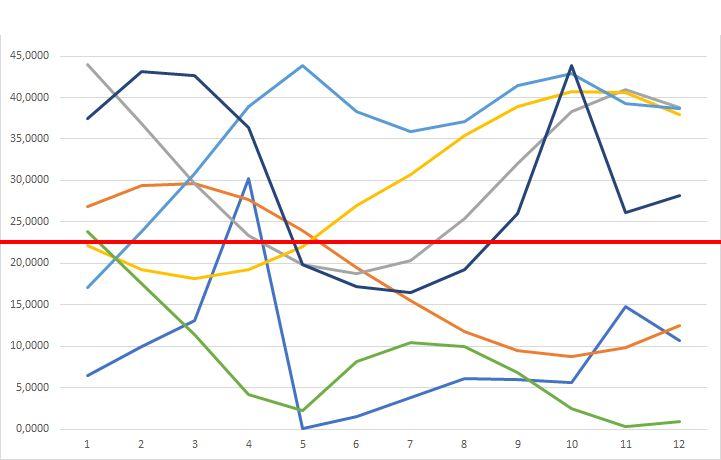

Development of the S&P 500 from January 1972 to December 1974

Progression of the crisis

Beginn der Baisse.

Alle wichtigen Aktienindizes der zukünftigen G7-Staaten erreichen ihren Tiefpunkt.

Der westdeutsche Markt kehrte innerhalb von 18 Monaten wieder auf das ursprüngliche Nominalniveau zurück.

Das Vereinigte Königreich kehrt wieder auf das ursprüngliche Niveau zurück.

Der westdeutsche Markt kehrte innerhalb von 18 Monaten wieder auf das ursprüngliche Nominalniveau zurück.

Causes

A period of excessive euphoria, preceding most crashes and in this case spurred by the first moon flights of the Apollo missions, sent share prices soaring to extreme heights.

However, despite the boom in the technology and computer industries, there was an extreme crash in share prices. The main cause of the crash, just like the bursting of the dotcom bubble in 2000, was low or no corporate profits. The average price-earnings ratio of technology stocks in 1968 was 114. Computer manufacturers were trading at 103 times their earnings. By comparison, stocks in the Dow Jones Index had an average P/E ratio of 16 in the peak year of 1968.

IBM, for example, could not meet the growing demand for its new System 370. The distribution system of bundling hardware and software was questioned by the Department of Justice and resulted in a 13-year-old lawsuit, the substance of which was eventually overtaken by developments in the industry and eventually shelved.

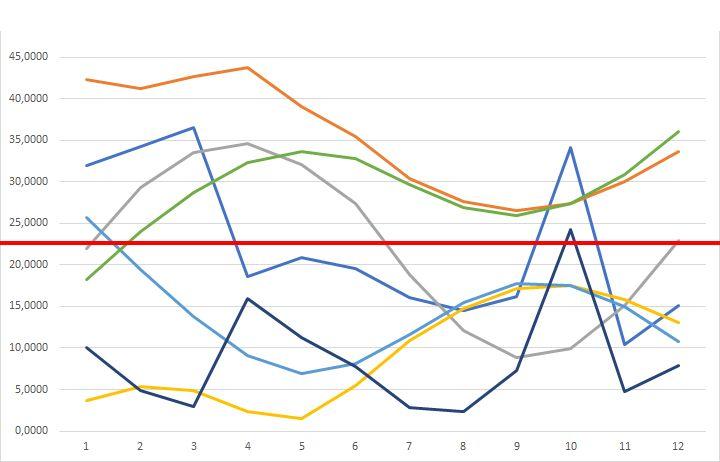

7 Medium-term fractal indicators - 1972

7 Medium-term fractal indicators - 1973

7 Medium-term fractal indicators - 1974