Black Thursday in America, Black Friday in Europe is a term for 24 October 1929 and the associated most momentous stock market crash in history. This stock market crash is considered to have triggered the Great Depression in the USA and the world economic crisis. The following bear market only reached its final low point in 1932.

History

On 24 October, the stock market opened 11% below the previous day’s level. To stem the panic, various institutions and financiers intervened with bids above the market price, so that the losses on that day were still modest. On the following Friday, share prices even recovered slightly.

The recovery was short-lived, however, as on 28 October 1929, known as “Black Monday”, the Dow Jones Industrial Average finished 13.47% lower, ending the day at 260.64 points on the index. The next day, known as “Black Tuesday”, the stock market fell another 11.73% to 230.07 points. Panicked investors sold a total of 16,410,030 shares.

This was preceded by a speculative bubble. In the 1920s, a seemingly unstoppable bull market had driven the Dow Jones up to 331 points – in 1923 it was still at around 100. There was talk of “Eternal Prosperity”. In this misjudgement of the situation, not only large investors and companies speculated, but also numerous small investors risked a lot; millions took out large short-term loans to buy shares (often the shares alone were considered collateral) in the hope of being able to pay them back with the profits. A stock exchange supervisory authority and many laws on regulation that are taken for granted today did not exist at that time.

There were warnings in advance, which were dismissed as doom and gloom. The majority of business leaders and economists were still convinced in mid-October that the highs would continue forever. For example, economics professor Irving Fisher was still proclaiming on 16 October: “It looks like stocks have reached a permanent plateau”. When the Dow Jones lost significantly in October 1929, nervousness broke out: It dawned on many how much of a risk they had taken. By 19 October, the Dow Jones had lost 15%; banks and investment firms began to buy in support.

Causes

The cause of the bear market is said to be the monetary tightening that the US Federal Reserve began in 1935. Put simply, the Fed had raised interest rates too soon after the Great Depression.

Ray Dalio, the manager of the world’s largest hedge fund Bridgewater Associates, wrote about this in an article of 18 May 2015 for Business Insider that the Fed raised interest rates eight years after the 1929 crisis following an accommodative monetary policy to stimulate the economy, which Ray Dalio believes was still too early.

- At the peak of the stock market bubble, the debt ceiling was reached, which also marked the peak of the economy (1929)

- In the midst of the depression, interest rates fell to zero (1931)

- The Fed cranks up the printing press and initiates a deleveraging (1933)

- Stock markets then began a rally (1933-1936)

- During a cyclical recovery, the economy also improved (1933-1936)

- The central bank tightens monetary policy, leading to a self-reinforcing downturn (1935)

Development of the DIJA from January 1920 to December 1954

Progression of the crisis

Der Dow Jones Index erreicht seinen Höhepunkt und schließt bei 381,17 Punkten.

Der Dow Jones Index verliert bis zum 15. Oktober 15%.

Der Dow Jones Index geht um 13,47% niedriger aus dem Handel und bendet den Tag bei 260,64 Punkten.

Der Dow Jones Index fällt um weitere 11,73% auf 230,07 Punkte.

Der Dow Jones Index erreicht seinen Höhepunkt und schließt bei 381,17 Punkten.

It was not until 23 November 1954 that the Dow Jones Industrial Average reached its previous high of 381.17 points. It thus took a full 25 years for the price declines from the stock market crash of 1929 to be fully recovered.

The consequences for the economy - world economic crisis

The stock market crash and the subsequent world economic crisis, which lasted until 1939, affected almost all social classes and changed the perspective and the relationship of an entire generation to the financial markets.

The so-called “Golden Twenties” with their great optimism, high consumption and strong economic growth now tipped over into the exact opposite – a phase of pessimism and flagging economic growth.

The stock market crash of 1929 cannot be considered the sole cause of the Great Depression, but it did accelerate the collapse of the world economy. By 1933, almost half of America’s banks had failed and nearly 15 million people – about 30% of the former workforce – slid into unemployment.

The government under President Franklin D. Roosevelt (1882-1945) helped to reduce the worst effects of the Great Depression. However, the US economy did not fully recover until after 1939, when World War II revived American industry.

Consequences

From the experience of Black Thursday, all stock exchanges later enacted rules that temporarily suspended trading in the event of an extreme fall in prices in order to curb any panic that might arise. In addition, there were further restrictions, for example on the credit financing of share transactions. Subsequent stock market crashes were therefore less dramatic than Black Thursday.

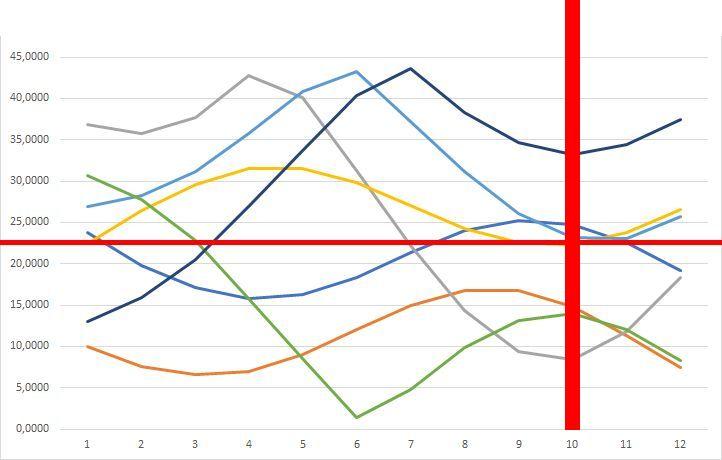

7 Medium-term fractal indicators - 1928

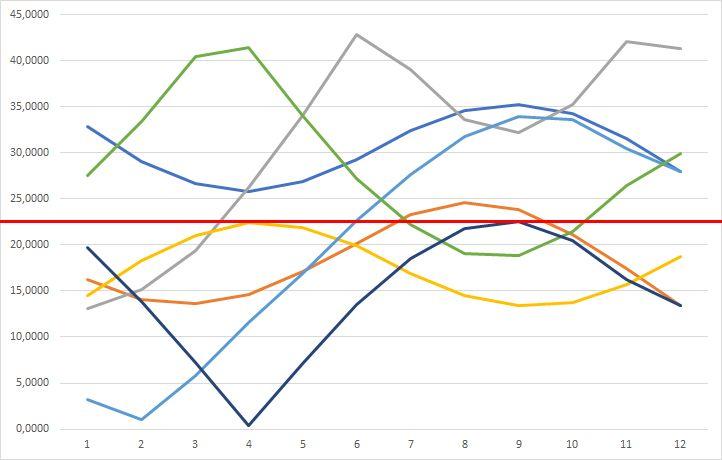

7 Medium-term fractal indicators - 1929