The 1987 crash is considered one of the worst in the financial industry.

Problems in the United States were considered decisive. In particular, some political decisions by US President Ronald Reagan and his Treasury Secretary James Baker laid the foundation for the collapse. Reagan’s economic policy, also called “Reaganomics”, provided for tax cuts for citizens and companies in order to stimulate the US economy.

Due to rising inflation and high trade deficits, confidence in the dollar declined. Uncertainty increased when the US Federal Reserve raised the key interest rate on short-term loans for the first time in three years. The Dow Jones had lost about 475 points in several jumps from its high in August to 13 October 1987. The devaluation of the dollar in the wake of the Plaza Accord seemed to have been stopped for the time being with the Louvre Accord in February 1987, but rumours of a dispute within the G7 countries surfaced in the media at the end of September. On the Friday before the stock market crash, the dollar exchange rate dropped abruptly to 1.77 DM. Uncertainty was heightened by an article in the following Sunday edition of the New York Times, in which Reagan’s Secretary of the Treasury, James Baker, indirectly spoke out against further support for the dollar exchange rate and threatened to let the dollar fall even further if the government under Chancellor Helmut Kohl did not show a willingness to compromise in the interest rate dispute.

Reagan’s policy led to the dollar being devalued and falling behind the German mark. To counteract this, Treasury Secretary James Baker announced an increase in American interest rates in October 1987.

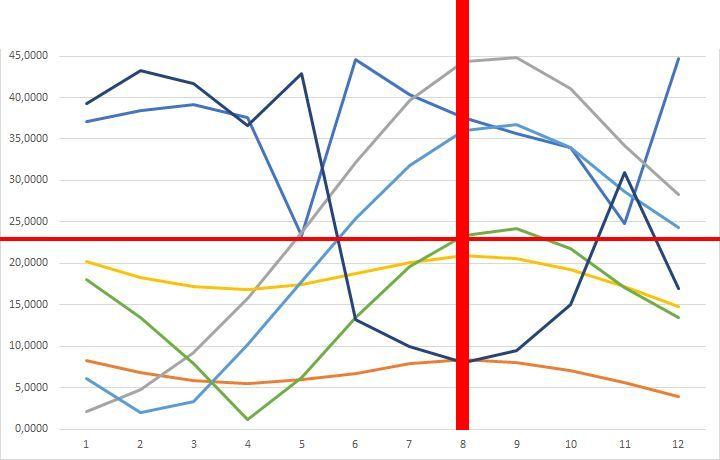

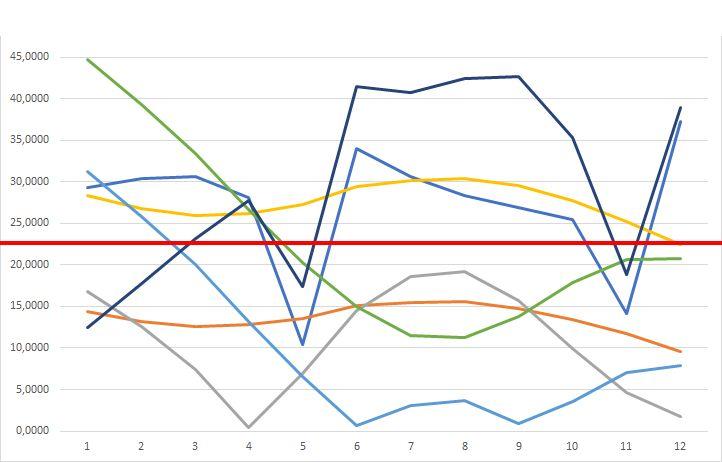

Development of the S&P 500 from January 1987 to December 1989

Progression of the crisis

Der Dow Jones Index verzeichnet einen Zuwachs von ca. 44%.

Die US-Regierung gibt ein über den Erwartungen liegendes Handelsdefizit bekannt. Der Dollar verliert an Wert.

"Dreifacher Hexensabbat“: monatliche Verfallszeiten von Optionen und Terminkontrakten fallen auf denselben Tag.

Schwarzer Montag - In den USA fällt der Dow Jones Industrial Average in einer einzigen Handelssitzung um 22,6%. Dies ist nach wie vor der größte eintägige Börsenrückgang in der Geschichte.

History

On 20 October 1987, the Dow Jones initially fell further to 1,739 points, the Nikkei 225 in Japan slid by 14.9 % (3,383 points) to 21,910 points. Trading was then suspended for a short time on many stock exchanges, partly because the computer technology at the time could not cope with the high volume of orders. This gave the US Federal Reserve time to pump liquidity into the market and cushion the crash. In addition, companies began to buy back their own shares (whether to support the price and/or to use the low prices as a buying opportunity). By the end of the week, the Dow Jones was trading at 1,951 points.

About 15 months after ‘Black Monday’, the Dow Jones returned to its pre-crash level at 2247 points.

Consequences

In response to the Wall Street crash, the major stock exchanges in Europe and Asia also collapsed. After the crash, the New York Stock Exchange (NYSE) introduced new regulations. The computer system was given a safety brake to prevent massive selling.

The Dow Jones is also monitored more closely. If it drops by more than 350 points, trading on Wall Street is interrupted for 30 minutes – at 550 points even for a whole hour.

7 Medium-term fractal indicators - 1986

7 Medium-term fractal indicators - 1987