Disclaimer

All information and publications on www.amend-finance.de/en/ are not to be understood as financial, investment, trading or any other kind of advice or recommendation, in particular no investment advice is given, the recipient of the information acts exclusively at his own risk.

Trading with Bitcoin involves a considerable risk of loss, up to and including total loss.

Blockchain

A blockchain is a distributed ledger with growing lists of records (blocks) that are securely linked together via cryptographic hashes.[1][2][3][4] Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data (generally represented as a Merkle tree, where data nodes are represented by leaves). The timestamp proves that the transaction data existed when the block was created. Since each block contains information about the previous block, they effectively form a chain (compare linked list data structure), with each additional block linking to the ones before it. Consequently, blockchain transactions are irreversible in that, once they are recorded, the data in any given block cannot be altered retroactively without altering all subsequent blocks.

Blockchains are typically managed by a peer-to-peer (P2P) computer network for use as a public distributed ledger, where nodes collectively adhere to a consensus algorithm protocol to add and validate new transaction blocks. Although blockchain records are not unalterable, since blockchain forks are possible, blockchains may be considered secure by design and exemplify a distributed computing system with high Byzantine fault tolerance.[5]

A blockchain was created by a person (or group of people) using the name (or pseudonym) Satoshi Nakamoto in 2008 to serve as the public distributed ledger for bitcoin cryptocurrency transactions, based on previous work by Stuart Haber, W. Scott Stornetta, and Dave Bayer.[6] The implementation of the blockchain within bitcoin made it the first digital currency to solve the double-spending problem without the need of a trusted authority or central server. The bitcoin design has inspired other applications[3][2] and blockchains that are readable by the public and are widely used by cryptocurrencies. The blockchain may be considered a type of payment rail.[7]

Bitcoin

Bitcoin was launched at the end of 2008 and the beginning of 2009. Since then, a block is generated every 10 minutes. In the beginning, the reward for solving the so-called difficulty was 50 bitcoin, i.e. 50 bitcoin were paid out to the miner for solving the first block.

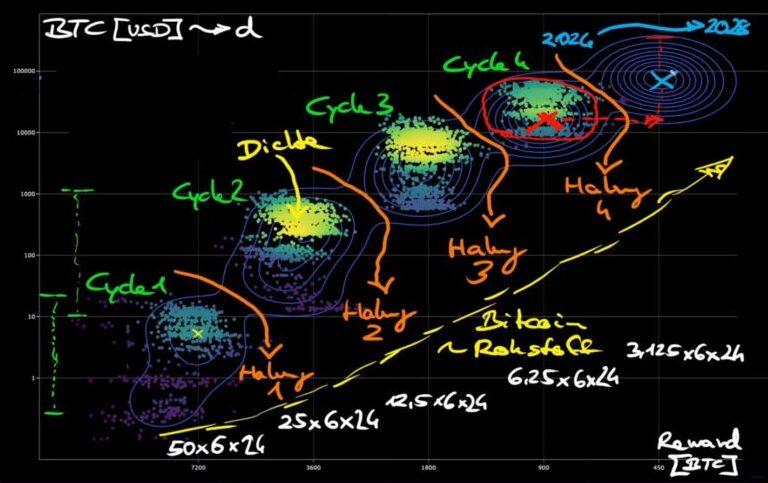

Bitcoin is subject to 4-year cycles, i.e. the reward is halved every 4 years. Until 2012, a miner received 50 bitcoin for the solution, in the next cycle the reward halved to 25, then to 12.5 and now in the 4th cycle to 6.25 bitcoin. In the 5th cycle, expected in April 2024, the reward will have halved a further time to then 3.125 bitcoin. This halving of the reward every 4 years will continue in the future.

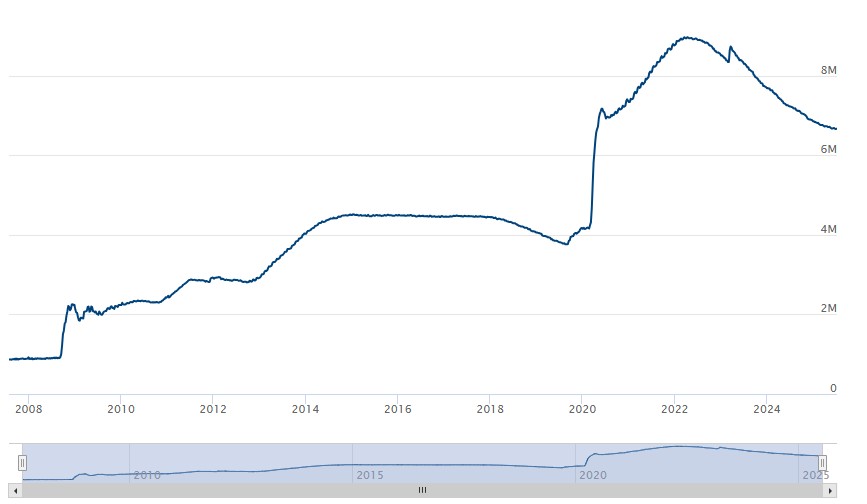

In the beginning, 7,200, then 3,600, then 1,800 and currently 900 Bitcoin were brought to the market per day through mining. Currently, there are about 19.2 million Bitcoin in circulation. After the next so-called halving, there will then be 450 Bitcoin per day. So we see a constant decline in the inflow of Bitcoin. At the same time, we are observing a price development whose dynamics can be read very well from the conspicuous cluster formation, see chart.

In the 1st cycle there was a price builing phase – the value was between $0 and $12. In the 2nd cycle there were already swings up to 1,000 $, in the 3rd cycle the range was between approx. 500 $ and 19,000 $, in the so far last, the 4th cycle between approx. 3,000 $ and 68,000 $ at the peak.

The density of the clusters can be seen very clearly in the above diagram. During the price discovery phase at the beginning, there is a low density. The underlying logic is that each point represents a daily price. The denser the clouds become, the more centralised pricing takes place.

In Cycle 4 you can see that the density formation is not yet complete. The red cross marks the current epicentre, which is quite a distance away from the high (approx. $ 68,000). At the moment the price is moving in the area of approx. $ 17,000, but still completely in the area of the cluster.

It is now exciting to look into the future regarding the upcoming cluster 5. The blue cross marks the expected mid-price in the centre of the cluster of about $70,000 after the next halving, which will take place in April 2024. However, the chart also clearly shows that the cluster can go down to the range of about $20,000, but also up to the range around $500,000.

Only when taking a logarithmic view of the linear price development can the actual price development of the Bitcoin from the beginning in January 2009 to the present be seen.

Our basic assumption is as follows: We currently do not see Bitcoin as a currency (not yet, but it can still come) and basically not as a digital asset, but as a virtual valuable commodity.

The example of gold can be used to explain this vividly. It took mankind millennia to extract the total amount of about 185,000 tonnes. The market capitalisation is currently about 11.5 trillion $. Currently, about 3000 tonnes are added per year, which means that in the next 62 years (assuming a constant inflow, which is not to be expected) the gold stock would double. As you can see, not much is happening over a very long period of time – so gold continues to be a very rare and thus also increasingly valuable commodity.

This is exactly our thesis regarding Bitcoin – we consider it a virtual valuable commodity. The fact is that the market capitalisation of Bitcoin is currently around $330 billion, which is roughly the same level as palladium. In the meantime, the value was even significantly higher at $1.2 trillion. This is the range in which silver is moving today.

Our assumption is that the basis of the price development is not only the market, as we know from the principle of supply and demand from the market economy. We also assume with regard to future price formation that – if you look at the history of Bitcoin as the most important crypto asset – the reward system or its halving will ultimately lead to a decline in the inflow of new Bitcoin. The total amount of bitcoin is limited to 21,000,000, and their generation will end in 2,140.

At the same time, it is important to know that the miners are in competition with each other and the hashrate, i.e. the computing power for solving the so-called Difficulty, is constantly increasing. So as the computing power increases, the reward decreases at the same time. This inevitably leads to a shortage of the good and thus to a sustained price increase.

Bitcoin DNA

Cycle 2 (2012-2016)

Cycle 3 (2016-2020)

Cycle 4 (2020-2024)

Bitcoin Ownership Distribution (December 2024)