Personal / telephone consultation

Advisory price per minute based on Amend Finance Portfolio Performance YTD (year to date)

- 11. July 2025

- 64.52 / minute

Global Markets Sunday News

Trump’s July 9 tariff deadline approaches

While concerns about impending tariffs and Trump’s comprehensive budget package weighed on European stock markets last week, new absolute records were set on Wall Street. The New York Stock Exchange was closed on Friday due to the national holiday. Meanwhile, prices fell in Europe as the Trump administration’s massive tariffs are set to take effect on July 9. Neither the European Union nor Japan or South Korea currently know where they stand. No compromises have been reached so far.

Tops of the week

Europäischer Luxusgütersektor: Die Aktien des Sektors profitierten von mehreren positiven Einschätzungen, die Analysten zu LVMH Anfang der Woche abgegeben hatten. Der seit Anfang des Jahres stark gebeutelte Sektor wurde durch diesen Zuspruch beflügelt.

Robinhood +13,69 %: Die Handelsplattform hat Token eingeführt, mit denen Kunden aus der Europäischen Union über 200 in den USA notierte Aktien und Fonds handeln können. Damit ist ein weiterer Meilenstein bei der Tokenisierung in der Finanzwelt erreicht.

Datadog +17,47 %: Die Analyseplattform für IT-Infrastrukturen rückt am 7. Juli in den S&P 500 auf und ersetzt den von HP übernommenen Netzwerkausrüster Juniper Network. Auch Robinhood und Applovin waren als Kandidaten infrage gekommen, doch die Entscheidung fiel zugunsten von Datadog aus.

Banco de Sabadell +6,41 %: Die spanische Bank verkauft ihre britische Tochtergesellschaft TSB für 2,65 Mrd. GBP an die Banco Santander. Die Transaktion könnte das feindliche Übernahmeangebot, das die spanische Großbank BBVA der Banco Sabadell unterbreitet hat, erschweren.

Vestas Wind Systems +8,04 %: Der weltweit führende Hersteller von Windkraftanlagen profitiert von einer Verlängerung der US-Steuergutschriften bis 2027, was die Prognosesicherheit für die kommenden Geschäftsjahre etwas erhöhen dürfte. Darüber hinaus gewinnt die europäische Offshore-Energie an Bedeutung und das Servicegeschäft legt wieder zu.

Glencore +5,63 %: Die geplante Aktionärsvergütung verhalf der Aktie des Rohstoffriesen zu einem Kurssprung. Die Unternehmensgruppe hat ein Aktienrückkaufprogramm im Volumen von 1 Mrd. USD angekündigt. Außerdem ist die Fusion zwischen Viterra, das sich zur Hälfte im Eigentum von Glencore befindet, und dem früheren US-Konkurrenten Bunge zum Abschluss gekommen.

STMicroelectronics +5,63 %: Dem Halbleiterhersteller kam die Anhebung der Empfehlung von Oddo BHF von Neutral auf Outperform zugute. Zudem wurde das Kursziel von 23 auf 32 EUR nach oben korrigiert.

Flops of the week

Centene -38.3%: US health insurers are in serious crisis. Faced with rising drug costs and an expected decline in risk adjustment payments of USD 1.8 billion, Centene had to withdraw its annual forecast. Following this announcement, the stock fell by 30%.

Fortive -25.91%: The technology group has completed the spin-off of its Precision Technologies business segment. The new company, named Ralliant, has been added to the S&P SmallCap 600 Index. At the same time, there has been a comprehensive restructuring of the management team.

VusionGroup -8.89%: Walmart sold 650,000 shares in the electronic label specialist, reducing its stake in the French group to 6.5% (remaining holdings: 1,111,200 subscription rights).

InPost -8.77%: The Advent investment fund is offering 3.5% of its stake in the owner of parcel delivery company Mondial Relay for sale.

Deutsche Bank -5.85%: After several difficult years, the Deutsche Bank Group is now approaching its 2015 high again. However, this upturn could be slowed by risks related to interest rate policy.

Mediobanca -4.93%: Banca Mediolanum has sold its entire stake in Mediobanca. This decision was made for purely financial reasons and to strengthen its financial position, but it was met with disappointment on the market.

Commodities

Energy: Oil prices are gradually continuing their upward trend. Brent crude recorded a weekly gain of 2%, but has not yet been able to recover the 16% decline that began at the end of June. Markets are focusing their attention on this weekend’s OPEC+ meeting. Analysts expect production to be increased again by 411,000 barrels per day in August. Decisions in previous months had been along the same lines. Since April, the OPEC+ production increase has totaled 1.8 million barrels per day. The target for the end of the third quarter is 2.2 million barrels. On the geopolitical front, the possible resumption of talks between the US and Iran on the nuclear program is putting downward pressure on oil markets.

Metals: The spot price of copper briefly exceeded USD 10,000 per ton in London. At the end of the week, prices fell again due to concerns about impending US tariffs. The copper price was also weighed down by the stronger dollar following the publication of positive economic data. Gold, meanwhile, benefited from investors’ search for safe havens as the deadline set by Trump in the tariff dispute is fast approaching. In addition, central banks have bought more gold (a total of 20 tons in May) as they continue to seek to diversify their currency reserves. Banks in Kazakhstan, Poland, and Turkey were among the most important buyers.

Agricultural products: Global grain production is expected to set a new record in 2025. According to a report by the FAO, 2.925 billion tons are expected. This represents an increase of 2.3% over the previous year, mainly due to better harvests of corn, rice, and wheat. Higher harvests in India and Pakistan are likely to make a significant contribution to the forecast wheat production of 805.3 million tons. For corn, favorable conditions in Brazil and an increase in acreage in India are having a positive impact on production. On the Chicago Stock Exchange, the price of a bushel of wheat rose slightly to 556 cents (contract maturing in September 2025), while the price of corn recovered to 420 cents.

Macroeconomics

Market sentiment: Although last week was short in the US due to the national holiday, it still provided investors with plenty to talk about, especially with regard to the labor market. The disappointing statistics published by ADP at the beginning of the week were quickly forgotten with the announcement of surprisingly good job growth figures. Against this backdrop, bond yields rose and stock indices hit new highs, at least in the US. Next week, the focus will be on tariffs, as the deadline for bilateral negotiations expires on July 9. Investors would therefore be well advised to brace themselves for some turbulence, even if there seems to be little news at present that could slow down the upward trend.

Cryptocurrencies

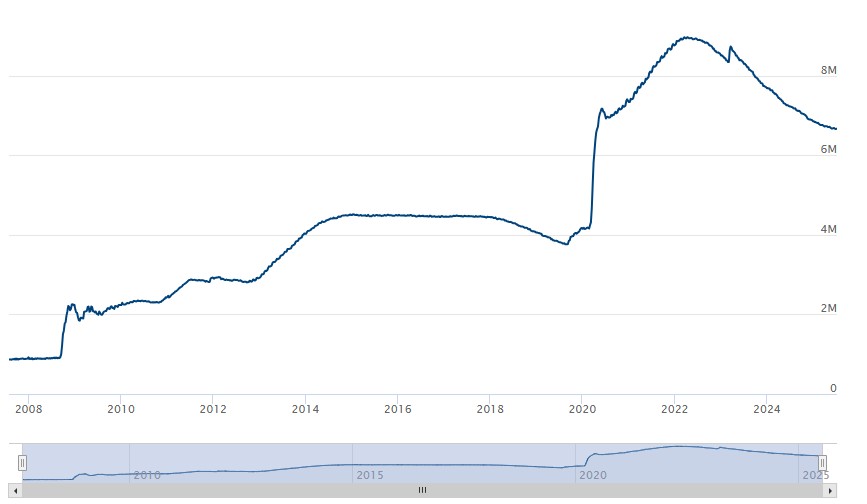

Bitcoin climbed above the USD 110,000 mark again at the beginning of the week, before falling back to around USD 108,000. Bitcoin spot ETFs, on the other hand, reached an all-time high. Total assets now amount to around USD 137 billion, which corresponds to 6.3% of all Bitcoins in circulation. This is a clear sign that institutional interest is not waning. However, the most impressive news of the week came from Wall Street. At EthCC 2025, Robinhood surprised everyone with the announcement of a decisive strategic shift: the tokenization of a wide range of stocks, pre-IPO stocks, and ETFs that can be traded in Europe 24/7, five days a week. The stock responded with an immediate 11% jump in price. Effective immediately, the platform combines traditional brokerage with Web3 infrastructure while expanding its service offering in the US to include staking of Ethereum (ETH) and Solana (SOL), crypto cashback, and improved tax management for portfolios (tax lots). This should please crypto investors as the blockchain ecosystem becomes increasingly entrenched in the traditional financial system.

Outlook

In the first quarter of 2025, European stock markets were still slightly ahead of the US, but Wall Street has almost made up for this lead in recent weeks. What can we expect in the second half of the year? The half-year results of the new reporting season, which are due in the next few days, will certainly provide some clues. Unless, of course, the cards are reshuffled by US tariff policy, as Trump’s ultimatum to his trading partners expires on July 9.

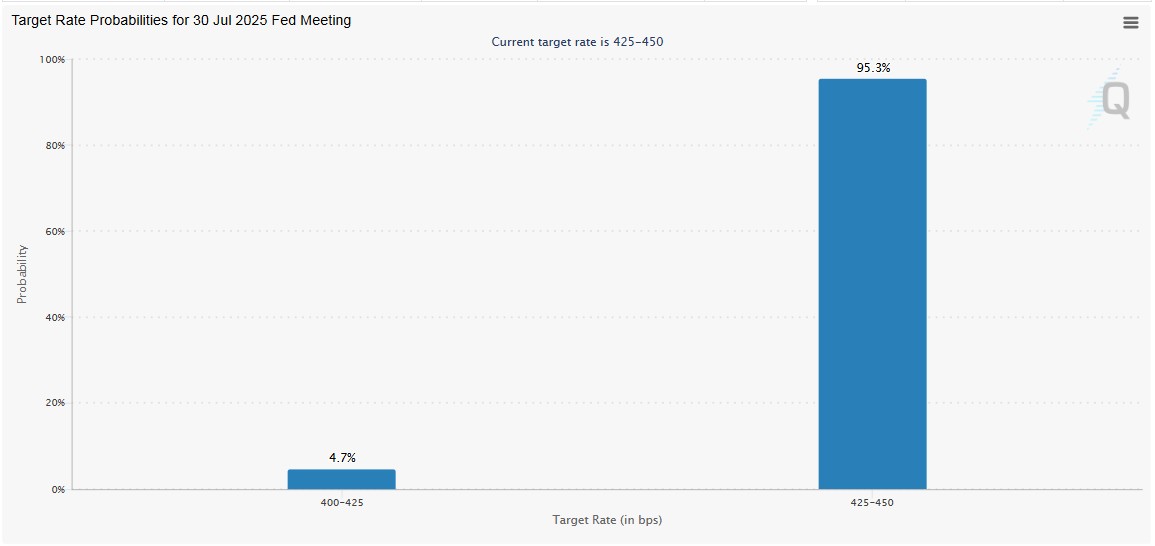

Looking at the economic data, next week is likely to be fairly quiet. However, we are eagerly awaiting the inflation figures from China and the minutes of the last meeting of the US Federal Reserve (Wednesday). The first important quarterly figures will be published from July 15. We wish you all a pleasant weekend.

Bitcoin | Gold

The path to freedom

Dr. Udo Amend, a renowned expert in the fields of cryptography and finance, has been working intensively on these topics for decades. With his extensive knowledge and experience, he sheds light on the fascinating connections between Bitcoin and gold in his book “Bitcoin | Gold – The Path to Freedom”.