The crash of 1966 occurred after two decades of almost uninterrupted economic growth and stock market gains following World War II. When the government under the Johnson administration began to increase government spending due to the Vietnam War and social programmes, the Federal Reserve responded by tightening credit conditions in early 1966. After reaching new highs in January and March of that year, the Standard & Poor’s 500 index fell by about 22% over the next 8 months. It then reached even higher heights by early 1968 as the consumer-driven economy pushed up corporate profits. Since the 1966 market downturn did not trigger a recession and did not play a role in the 1966 or 1968 elections, it was soon forgotten.

History

In the midst of the robust post-war expansion, the Fed began to fear inflation increasingly and eventually tightened monetary policy to the point that it threatened the profitability of financial institutions. By late August 1966, a mess in the taxable municipal bond market sparked rumours about the solvency of savings banks. The ensuing frantic reaction by money market banks resulted in an uncontrolled panic, necessitating action by the Federal Reserve. The Fed was thus forced to step in as a lender of last resort to save the municipal bond market.

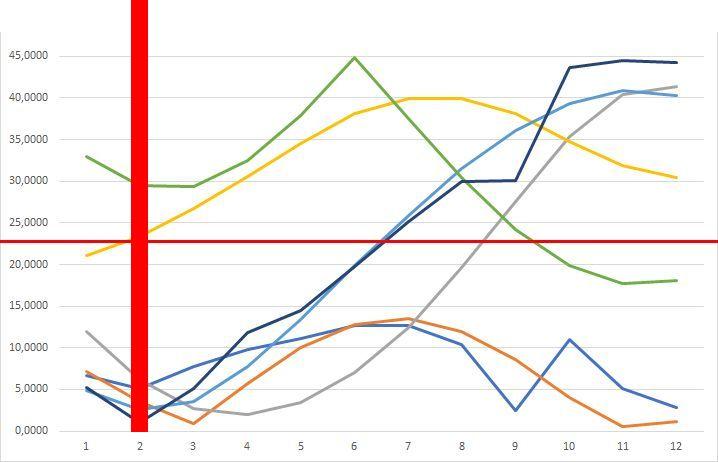

Development of the S&P 500 from January 1966 to December 1967

Progression of the crisis

S&P 500 Rückgang von -20,8% gegenüber dem vorherigen Hoch vom 09. Februar 1966 auf 74,53 Punkte.

S&P 500 Rückgang von -22,2% auf einen Tiefpunkt bei 73,20 Punkten

Vollständige Erholung des S&P 500.

Conclusions

As a result of the FED’s intervention, the economy continued to expand, new financial practices emerged and were validated, debt ratios rose, memories of the Great Depression faded and markets expected the US government and Federal Reserve to rush to the rescue when needed.

In retrospect, however, 1966 can be seen as a harbinger of difficult times ahead. The market hit some new highs in the late 1960s and early 1970s, but inflation picked up and the government bled the gold reserves that supported the dollar until 15 August 1971, when President Nixon abandoned the gold standard. Then came the brutal market downturn and recession of 1973-75, another bout of inflation and more severe recessions in 1980 and 1981. 1966 marks the beginning of a 15-year period when stocks barely rose. Only extremely patient investors were finally rewarded.

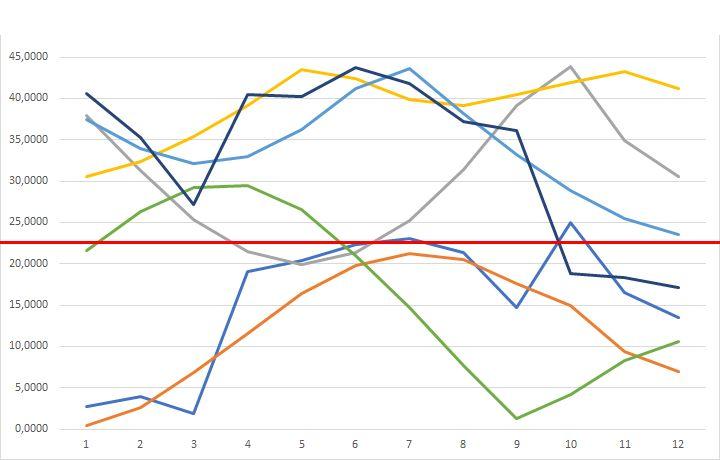

7 Medium-term fractal indicators - 1965

7 Medium-term fractal indicators - 1966