When Paul Volcker became head of the US Federal Reserve in 1979, the inflation rate was 13 percent. His shock therapy helped. In 1979, the inflation rate had reached 13 percent with key interest rates around eleven percent. Volcker and his colleagues at the FED raised the key interest rates to an unimaginable 20 percent today and accepted a severe economic crisis for it. The unemployment rate rose to more than 10%. Millions of Americans lost their jobs. The monetary policy led to severe protests because loans became more expensive as a result of high interest rates. Especially construction companies, real estate owners and farmers suffered from the restrictive monetary policy.

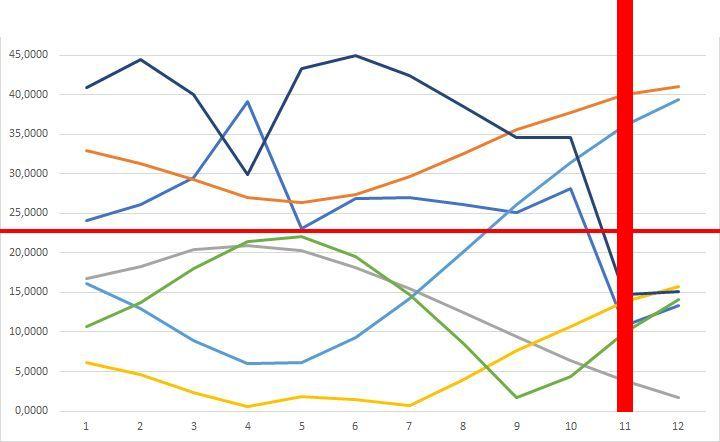

Development of the S&P 500 from January 1979 to December 1984

Progression of the crisis

Paul Volcker übernimmt das Amt des Chefs der FED.

Der S&P 500 erreicht ein Zwischenhoch von 140,52 Punkten.

Die Inflation sinkt auf 6%.

Die Inflation sinkt auf 3%.

Evolution of the crisis

From 1973 to 1979 alone, with the exception of one year, inflation was over 5 %. In 1980 inflation rose above 12%, while in 1981 it was just under 9%. For comparison: since 1982, only in 1990 has the annual inflation rate in the course of a calendar year been above 5 %. In 23 of the 39 years from 1982 to 2020, inflation was below 3%. From 1966 to 1979, 3% was the lowest annual inflation rate.

Actions

Against great pressure from economists, business and the public, then US President Jimmy Carter, who made Volcker head of the FED, decided to end inflation. Paul A. Volcker became head of the Federal Reserve System in 1979. He finally stopped inflation by raising the so-called “fed funds rate” (the interest rate at which US financial institutions lend money to each other to settle their balances under reserve requirements at the central bank) to about 20% in the early 1980s. The essence of his monetary policy was to radically slow down the economy and thus break price pressures. He achieved this with a radical increase in key interest rates to almost 20 %, which still corresponded to almost 10 % in real terms (adjusted for inflation).

Conclusions

The drastic recession caused by Volcker and high unemployment finally ended the previously prevailing trend towards ever higher prices and wages and brought inflation expectations and thus inflation itself to a halt:

When workers no longer expect inflation to rise continuously, they no longer demand corresponding wage increases. The so-called wage-price spiral then ends and inflation decreases. The central bank can then lower the key interest rates again, the economic situation improves again and employment increases again. This is exactly what Vocker has achieved with his policy.

Under the Obama administration

In a speech on 21 January 2010, US President Barack Obama announced his intention not only to regulate the big banks more, but also to restrict their proprietary trading activities.

Volcker Rule

'Banks are not allowed to participate in, own or finance hedge funds and private equity funds and to engage in proprietary trading [trading in financial instruments (money, securities, foreign exchange, foreign notes and coins, precious metals or derivatives) in the bank's own name and for its own account and not directly triggered by a client transaction] at their own risk. Banks must limit their securities trading activities to client orders and may not themselves take risky positions for their own speculative motives.'

Paul Volcker

7 Medium-term fractal indicators - 1979

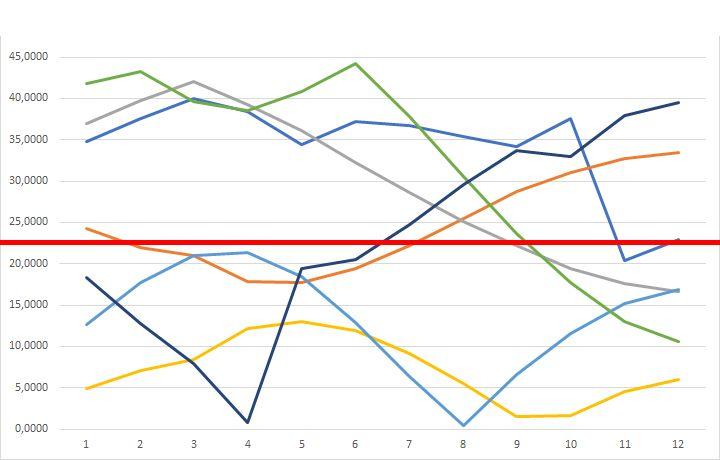

7 Medium-term fractal indicators - 1980