The Flash Crash of 1962, also known as the Kennedy Slide, is the name given to the decline in the stock market from December 1961 to June 1962 during the administration of John F. Kennedy. After growing for decades since the Wall Street Crash of 1929, the stock market peaked in late 1961 and crashed in the first half of 1962. During this period, the S&P 500 fell 22.5% and the stock market did not make a stable recovery until after the end of the Cuban Missile Crisis. The Dow Jones Industrial Average fell by 5.7 % and recorded the second largest decline in history with a drop of 34.95 points.

History

After the Wall Street crash of 1929, speculators became more cautious and hesitant to hold on to stocks for long periods of time. As a result, the tendency to cluster on the bearish side of the market – betting on falling share prices – intensified, pushing share prices further down. These bear raids enabled many Wall Street investors to make a fortune, because proper regulation of inside information had not yet taken hold. Joseph P. Kennedy, a famous and prominent bear raider, had made much of his fortune by trading pools of stocks. As his wealth continued to grow, he later entered politics as a strong supporter of Franklin D. Roosevelt into politics. Kennedy was eventually appointed chairman of the U.S. Securities and Exchange Commission, a federal agency set up by Franklin D. Roosevelt to investigate current speculative transactions and prevent a downturn like the 1929 crash. During his tenure as head of the commission, Kennedy did thorough work and made a name for himself and his family. His success and reputation may have eventually helped his son win the presidency in the 1960 election.

In the period leading up to the Kennedy slide of 1962, the economy was experiencing a rapid boom. From February 1951 to December 1959, the real GDP of the United States had increased substantially. Stock prices had been rising steadily since the late 1940s, and when John F. Kennedy took office in 1961, he promised that the upswing would continue. However, after the stock market continued to rise until December 1961, there was a massive drop. By June 1962, the S&P 500 had fallen 22.5%. The Dow Jones Industrial Average fell by 5.7 % on 28 May 1962 alone, which was called the “Flash Crash of 1962”.

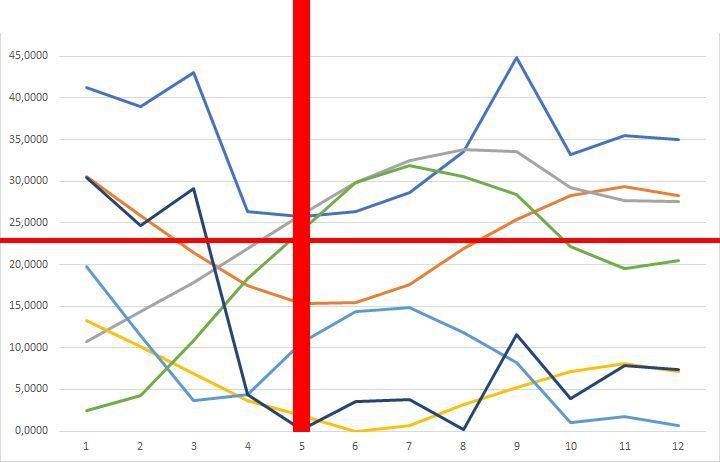

Development of the S&P 500 from January 1959 to December 1964

Progression of the crisis

Kursanstieg um 27%.

Der DJIA (Dow Jones Industial Average Index) fällt um 27 %.

Der S&P 500 Index fällt um knapp 23%.

Conclusions

Investors poured complaints on the White House and asked for help, which the SEC described as “general disenchantment with the market”. As US households reduced their stock purchases, about 8% of stockbrokers went out of business during 1962 and even companies like Merrill Lynch felt the pinch.

Since investors were not “bailed out” of their mutual funds, they sharply reduced their fund investments. It took two years for fund sales to return to their old levels.

The problems that regulators tried to solve more than half a century ago still exist to some extent today.

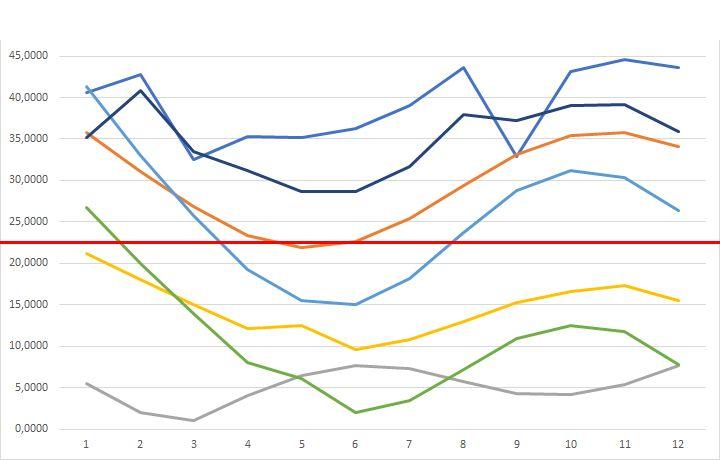

7 Medium-term fractal indicators - 1961

7 Medium-term fractal indicators - 1962