Global Markets Sunday News

Tops of the week

Kratos Defense & Security +7,88 %: The company benefited from new contracts with Airbus Defence and the US Department of Defense for the delivery of satellites and hypersonic drones. This means that the outlook for the space and defense divisions is now more certain again.

Moderna +18,09 %: The US biotechnology company has received EU approval for its Covid-19 vaccine mNexspike. In addition, the US Food and Drug Administration (FDA) has begun reviewing the application for approval of Moderna’s novel flu vaccine, and BioNTech has filed a patent infringement lawsuit.

Moncler +12,47 %: The Italian luxury goods group increased its sales by 7% in the fourth quarter. The markets in Asia and America contributed most to this growth.

BAE Systems +10,01 %: The defense contractor reported a 9% increase in profits in fiscal year 2025 and a record order backlog worth GBP 84 billion. The renewed increase in geopolitical tensions also benefited the entire sector.

Air France-KLM +7,12 %: The airline published significantly improved financial results, which were supported by falling oil prices.

Orange +3,47 %: The group has raised its forecast for organic cash flow. Orange justifies this step with the consolidation of its Spanish joint venture MasOrange and growth in the area of cybersecurity.

Flops of the week

Carrefour -2,36 %: The figures published by the retail chain fell short of expectations. They were impacted by currency effects and the consolidation of Cora and Match.

Bayer -5,01 %: According to the German company, its Monsanto division will pay USD 7.25 billion to settle pending litigation in the US relating to the pesticide Roundup.

Walmart Inc. -8,14 %: The retail giant presented a conservative outlook for 2026, citing the pressure on consumers in light of the unstable environment. The company’s management wants to start the year with a cautious approach.

Nexans -8,36 %: The cable manufacturer was punished because the figures published for 2025 fell short of expectations and the outlook was also disappointing.

Eramet #VARIA_4752##: After the mining company announced a net loss of EUR 477 million for 2025 and a capital increase, its share price went into a tailspin.

Waw materials

Energy: Oil prices rose sharply last week. While Brent crude from the North Sea cost more than USD 71, its US counterpart WTI reached its highest level since August at over USD 66. Investors are pricing in an ever-higher risk premium in view of the increasing tensions between the United States and Iran. Indeed, the geopolitical situation in the Middle East is dominating the news. The US government is increasing pressure on Tehran to reach a new agreement on Iran’s nuclear program. Donald Trump has set an ultimatum of 10 to 15 days and is threatening military action if the negotiations fail. Despite the talks in Geneva, US Vice President J.D. Vance believes that Iran is not accepting the American demands. An easing of tensions therefore seems unlikely. The scenario of a short or prolonged conflict is causing particular concern among market participants, as it poses a threat to the energy infrastructure in the Persian Gulf. The main risk concerns the Strait of Hormuz. A blockade of this strategically important passage would cause a severe supply shock.

Metals: Precious and industrial metals moved in different directions this week. Gold rose due to geopolitical tensions, while the price of copper slumped in light of oversupply. The price of gold is hovering around the symbolic mark of USD 5,000 per troy ounce. Investors prefer this safe haven asset in view of the growing uncertainty caused by the dispute between the United States and Iran. The increasing tensions are also strengthening the US dollar, which is putting a damper on the industrial metals segment. The price of copper fell to $12,800 (spot price) in London, further weighed down by an increase in inventories and lower trading activity due to the Chinese New Year, when markets in China remain closed.

Agricultural commodities: The price of cocoa continues its rapid decline. This downward spiral is due to the expected improvement in supply as a result of favorable weather conditions for harvests in West Africa and sluggish demand. The price of soybeans reached a three-month high in Chicago this week at 1,153 cents per bushel (contract maturing in May 2026). The market expects China to increase its purchases. Wheat also rose in price to 569 cents per bushel (contract maturing in May 2026), while corn is trading at around 438 cents.

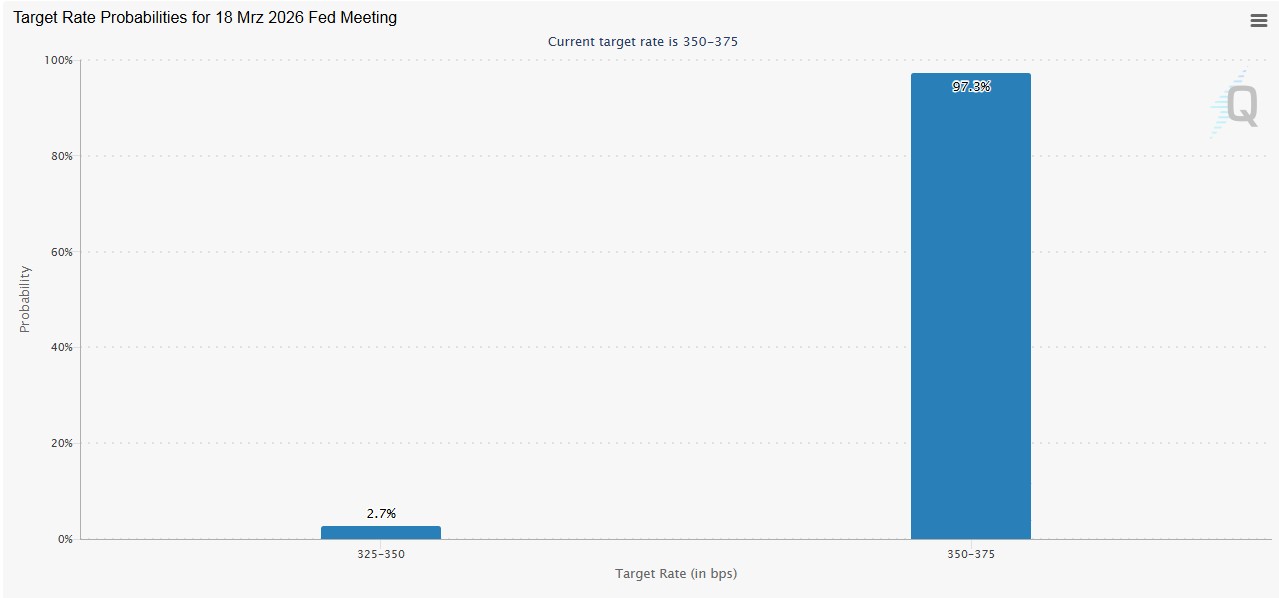

Market sentiment: This week, investors eagerly awaited two important economic indicators: economic growth and inflation in the United States. In the fourth quarter, GDP grew by +1.4% compared to the same period last year, only half as much as expected. The 43-day shutdown of the US government last fall appears to have had a negative impact on economic activity. Consumer spending rose by only 2.4% in the last three months of 2025. In the previous quarter, the growth rate had been 3.5%. At the same time, the US consumer price index rose by 3% in December compared with the previous year, which was more than expected – the sharpest increase since February 2025. However, investors still have doubts about growth. This week, the yield on 10-year US government bonds briefly fell below 4%, reaching its lowest level so far this year. So can we now expect further interest rate cuts by the US Federal Reserve? As the minutes of the January meeting published this week show, the situation is anything but clear. The majority of the members of the Open Market Committee seem to be in favor of maintaining the status quo. In addition, the US Supreme Court ruled on Friday that the tariffs imposed by Donald Trump were unlawful. However, a response from the White House is to be expected, as the US government still has other legal options available to it to continue enforcing its tariff policy.

Cryptocurrencies: Bitcoin declined for the fifth consecutive week. During this period, the market-leading cryptocurrency fell 28% from $93,500 to $67,000—a significant setback for investors. Since the beginning of the week, BTC has lost just under 3%. The same applies to Bitcoin spot ETFs: for the fifth week in a row, the total assets under management in BTC-linked exchange-traded products shrank – this time by another $400 million. Against the backdrop of developments in recent weeks, it is therefore hardly surprising that the crypto universe continues to suffer from the risk aversion prevailing in the markets: Investors are selling off positions in tech stocks and thus also crypto assets and reorienting themselves. Ether (ETH) lost 1.58% this week and was last trading at around $1,930. Solana (SOL) fell 4.26% to around $82, while XRP lost 5.75% of its value, falling back to $1.39.